Have you ever run into an error while using FintechAsia? Error Code FintechAsia shows up when something goes wrong with transactions, settings, or connections. These codes help you figure out what went wrong so you can fix it quickly. They can happen for many reasons like network issues, wrong settings, or payment problems.

By understanding what each error means, you can resolve issues faster and keep things running smoothly. This guide will help you understand and solve these common errors easily.

What Is Error Code FintechAsia – Detailed Answer Here!

Error Code FintechAsia refers to specific error messages that appear when something goes wrong while using the FintechAsia platform. These codes help identify problems with transactions, server issues, or authentication failures. They often occur during payment processing, API integrations, or connectivity problems.

Each error code points to a different issue, helping businesses quickly find and fix the root cause. By understanding these error codes, businesses can avoid delays, minimize disruptions, and ensure smooth financial operations across systems.

Types Of Error Codes Fintechasia – You Must Read!

Here are some of the most frequent FintechAsia error codes, along with what they mean and how you can resolve them:

Error Code 500: Internal Server Error

This error indicates a problem on the server side that prevents your request from being processed. It may happen due to:

- High server traffic during peak trading hours.

- Overloaded servers from API integrations.

Error Code 404: Page Not Found

A 404 error occurs when the requested resource is unavailable. This can happen because of:

- Incorrect or outdated API endpoints.

- Services being unavailable in specific regions.

Error Code 401: Unauthorized Access

This error happens when authentication fails. It may be caused by:

- Expired or invalid authentication tokens.

- Incorrect or outdated API credentials.

Error Code 303: Payment Declined

This error appears during financial transactions and can be triggered by:

- Insufficient funds in the account.

- Rejection by the bank or payment gateway.

Error Code 403: Forbidden

A 403 error happens when the server understands your request but refuses to authorize it. Common causes include:

- Insufficient user permissions or access rights.

- Restricted access to certain resources or services.

Error Code 408: Request Timeout

This error occurs when a request takes too long to process, typically due to:

- Poor network connectivity or high server load.

- Unstable or slow internet connections during peak periods.

Error Code 502: Bad Gateway

A 502 error occurs when the server receives an invalid response from an upstream server. It can happen because of:

- Miscommunication between servers.

- A third-party service being temporarily unavailable.

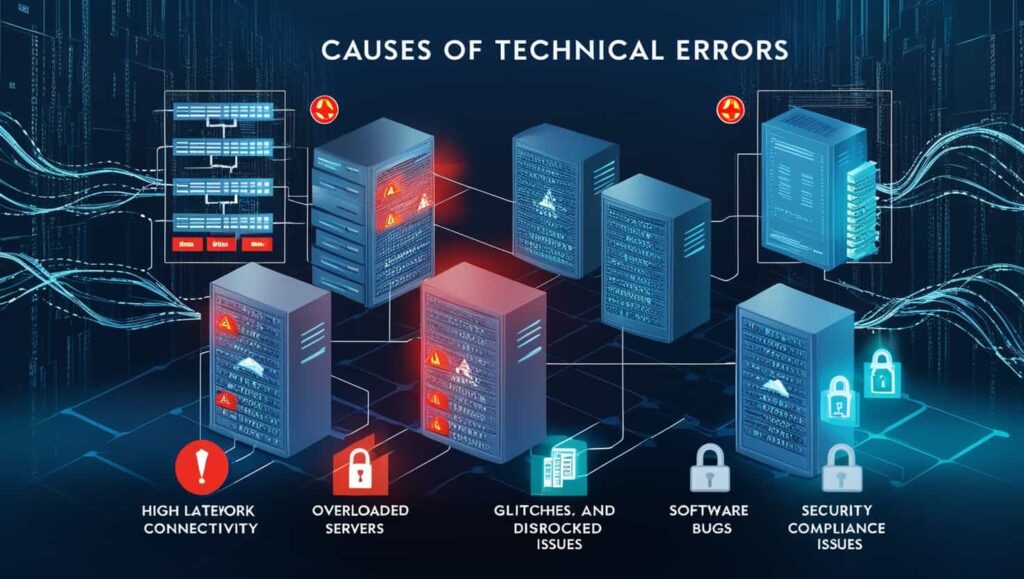

What Causes Error Codes FintechAsia – Key Issues You Need to Know!

- Network Connectivity Issues: High latency between U.S. servers and Asian platforms can lead to failed data transmissions, especially during periods of high traffic or unstable connections.

- Server Overloads: During major financial events, like market openings or closings, increased server traffic may cause delays or timeouts as FintechAsia servers struggle to handle the volume.

- Software Bugs and Integration Issues: Mismatched software versions, incorrect API configurations, or incomplete updates can create bugs, particularly during third-party software integrations.

- User Input Errors: Simple mistakes, such as incorrect account numbers, date formats, or currency discrepancies, can cause errors, especially when different regions have different formatting standards.

- Compliance and Security Protocols: Strict data protection and security regulations in Asia may trigger errors like 401 Unauthorized when not properly followed, impacting user access and data processing.

Which Tools Can You Use To Troubleshoot Errors? – Lets See!

| Tool | Description |

| Postman | A tool for testing and troubleshooting API endpoints by sending requests and checking responses. |

| Pingdom | Monitors website and server performance, alerting you to downtime or performance issues. |

| Wireshark | A network protocol analyzer to diagnose network issues by capturing and analyzing data packets. |

| Traceroute | A diagnostic tool that traces the path of data to identify network bottlenecks or failures. |

| New Relic | Provides real-time application performance monitoring, helping to identify and resolve bottlenecks. |

| FintechAsia’s Diagnostics | Built-in diagnostic tools from FintechAsia that provide error logs and reports to identify root causes. |

How Can You Troubleshoot Error Code Fintechasia Effectively? – Easy Steps To Fix Its Issues!

Conducting System Checks And Maintenance:

Regularly maintain your servers and software to prevent errors. Use real-time monitoring tools to detect potential issues early, allowing you to address them before they cause significant disruptions. Keeping your system updated with the latest patches also reduces the risk of errors.

Managing Traffic With Load Balancing:

Distribute traffic across multiple servers to prevent any single one from becoming overwhelmed. Load balancing ensures smooth operations even during peak times, significantly reducing the risk of server errors like Error Code 500. Consider using cloud-based load balancing solutions for more scalability and efficiency.

Verifying Api Configurations:

Double-check that your API credentials are up-to-date and configured correctly. Test API endpoints regularly to confirm compatibility with FintechAsia systems, which helps prevent integration issues. Also, automate API checks to detect and resolve issues faster before they impact business operations.

Addressing Network Issues:

Use tools like ping tests and traceroutes to pinpoint network bottlenecks that could cause delays or failed transactions. Consider establishing redundant network pathways and setting up automatic failovers to ensure connectivity even during network disruptions. A well-designed network infrastructure can prevent many connectivity-related errors.

Enhancing Security Protocols:

Strengthen your authentication protocols with methods like multi-factor authentication (MFA) to protect against unauthorized access errors. Regularly update security tokens and encryption methods to maintain data protection. Additionally, ensure that your security practices align with regional compliance requirements to avoid regulatory issues.

Testing And Optimizing Systems Regularly:

Run regular stress tests on your systems to identify potential weaknesses before they lead to failures. Optimize database queries and other critical operations for better performance, and ensure that backup systems are fully functional. Proactive testing helps ensure that your systems can handle real-world traffic and errors effectively.

Proactive Strategies To Prevent Error Code Fintechasia – Key Steps For Success!

- Implement AI-Based Monitoring Systems: Use AI to detect patterns and predict potential errors before they occur. This helps identify server overloads and integration issues proactively, reducing system downtime.

- Regular System Updates: Keep your system up to date with the latest software updates and security patches. Regular updates ensure compatibility and fix critical bugs that could lead to errors.

- Test New Integrations Thoroughly: Always test third-party integrations in a controlled environment before going live. This minimizes the risk of integration errors that could disrupt your operations.

- User Training and Onboarding: Provide detailed training and documentation to employees. Clear guidelines on data entry and troubleshooting can prevent user errors from causing system disruptions.

- Backup Systems and Redundancies: Implement backup systems to ensure continuity during unexpected failures. Redundant servers and networks help minimize downtime during peak traffic periods or technical issues.

How Do Regulatory Differences Impact Error Handling?

Regulatory differences can have a big impact on how errors are handled, especially for businesses operating in multiple regions. Different countries have their own rules, like data privacy laws (e.g., GDPR in Europe or CCPA in California) and financial reporting standards (e.g., FATCA in the U.S.).

These rules affect how errors are logged, fixed, and reported, especially when they involve sensitive information. For instance, errors involving user data may need to follow strict privacy guidelines, while transaction errors may require reporting to meet local financial rules. Failing to follow these regulations during error handling can lead to fines, so businesses must ensure their error management processes comply with the laws of each region they operate in.

Real-World Case Studies – Lessons Learned From Resolving Fintechasia Errors

Dealing With Server Overload During A Trading Surge:

A U.S.-based investment firm faced delays in processing transactions during Asian market openings. The firm implemented load balancing and upgraded server infrastructure. This reduced downtime by 85%, improving transaction speed during peak trading periods.

Fixing Api Integration Errors In Payment Processing:

An e-commerce company experienced payment failures due to incorrect API configurations. They switched to a centralized API management tool and conducted thorough tests. This change resulted in a 99.9% uptime and reduced payment failures.

Preventing Errors Through Regular System Audits:

A global financial service provider ran regular system audits and identified a bug that could have caused outages. Fixing the bug ahead of time prevented a major issue. This proactive approach ensured smooth operations during high traffic periods.

Handling Data Protection Compliance In Multiple Regions:

A multinational corporation faced challenges with data protection laws in Asia. They realized non-compliance could lead to penalties, so they updated their error-handling processes. This ensured they remained compliant with both regional and global privacy regulations.

FAQs:

Can time zone differences impact error resolution?

Yes, time zone differences can cause delays in error resolution, especially if issues occur during off-hours in another region. Aligning support teams with global working hours or using automated systems can help mitigate this.

How do server overloads cause FintechAsia errors?

Server overloads happen during high traffic, such as market openings, causing processing delays. Load balancing and scaling infrastructure can prevent this. This reduces errors like Error Code 500 during peak times.

What security protocols should I follow to avoid FintechAsia errors?

Use multi-factor authentication (MFA), regular token updates, and strong encryption methods. These steps prevent unauthorized access errors. Keeping security measures up-to-date ensures system safety and prevents errors like Error Code 401.

Can system maintenance help prevent FintechAsia errors?

Regular maintenance helps detect potential issues early and ensures your system runs smoothly. Apply updates and patches promptly to avoid compatibility issues. Regular checks reduce the risk of system errors.

How do I ensure my API integration with FintechAsia is working correctly?

Regularly test your API endpoints for correct responses. Use tools like Postman to check configurations and ensure compatibility. Keep your API credentials updated to avoid integration issues.

Conclusion:

Error Code FintechAsia can cause disruptions in financial transactions and systems if not handled promptly. Understanding the common causes and knowing how to troubleshoot these errors is key to preventing downtime.

Regular system checks, proper API configurations, and adherence to security protocols can significantly reduce the risk of errors. Proactive measures like real-time monitoring and AI tools can help detect issues early. By staying informed and prepared, businesses can ensure smoother operations and maintain customer trust.

Must Read: